Midlands Engine Investment Fund II -

Debt Finance

MEIF II - FDC Debt Finance - From £100,000 to £2million

As businesses grow, larger amounts of finance can be needed to move them to the next level. Funding might be for hiring a new team, launching a new product or service, funding marketing costs, or purchasing new machinery or equipment. The Midlands Engine Investment Fund II – Debt Finance is designed for companies that can demonstrate growth potential.

Investment from: £100,000 to £2million

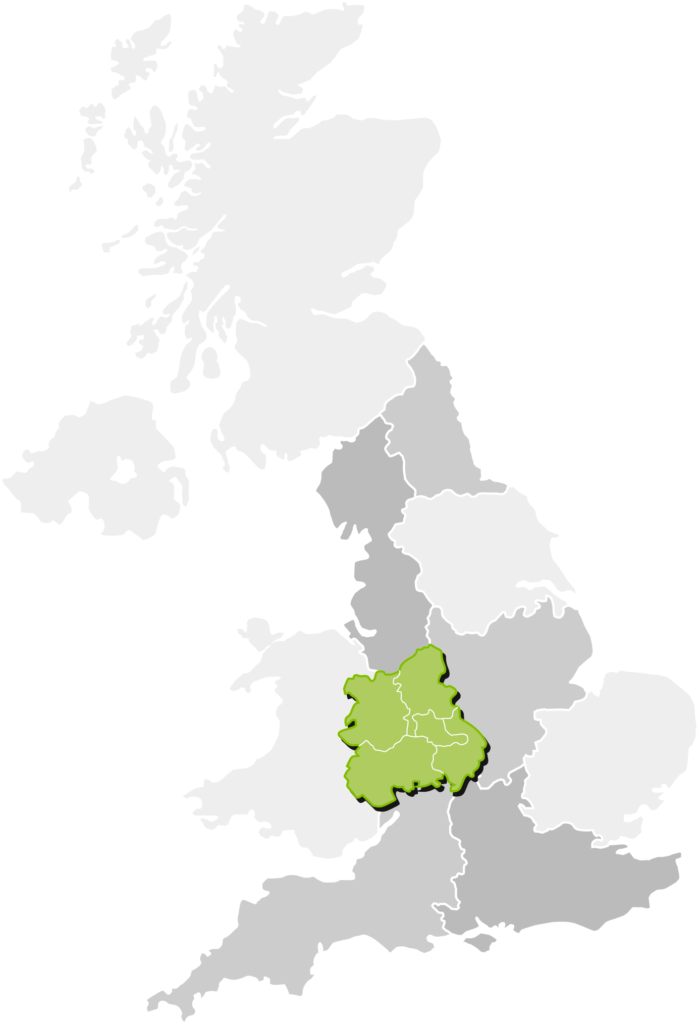

Location: West Midlands

Transaction: For accelerating growth

Sector: Any considered

Key Features

Transforming the finance landscape

Are you an SME looking for debt investment required for growth? If your business has fewer than 250 employees and turnover less than €50million, you can apply for funding.

- Loan investment between £100,000 to £2million

- Can be utilised alongside other debt facilities to a total of £5million

- For SME businesses able to demonstrate a track record of sustained sales growth or viable growth plans

- Available to those unable to raise sufficient finance to support their growth from traditional financing sources

Targeting key business growth ambitions, get in touch for discuss your investment requirements. Investment can be used but not limited to:

Hiring new staff

Changing premises

Product Development

Exploring new markets

Purchasing equipment

Looking for investment?

Regional growth

Investing in West Midlands SMEs

Investment Range: Tailored financial support between £100,000 and £2 million, but with capacity to co-invest alongside other funds.

Geographical Focus: Exclusively supporting businesses operating within the West Midlands, extending our reach across the entire region.

Funding Inclusivity: Focusing on nurturing business diversity, equity, and inclusion (DEI), welcoming applications from all sectors, especially from underrepresented networks like female founders.

Transforming the finance landscape for regional SMEs

Download our investment info pack and subscribe

Supported by Nations and Regions Investment Limited, a subsidiary of British Business Bank plc, the Bank is a development bank wholly owned by HM Government. Neither Nations and Regions Investment Limited nor British Business Bank plc are authorised or regulated by the Prudential Regulations Authority (PRA) or the Financial Conduct Authority (FCA).

Unlocking your business' growth potential

The Midlands Engine Investment Fund II – Debt Finance has been designed for SMEs that call the West Midlands their home. Whether you’re breaking new ground in high-tech industries, pioneering low carbon energy solutions, leading advancements in life sciences, or innovating within the manufacturing sector, we’re here to amplify your impact. Our focus is on established SMEs poised for further growth, from any sector, with a keen eye on businesses that are shaping their future.

Start the journey with FDC

We’re not just about funding; we’re about fostering growth, facilitating innovation, and supporting the aspirations of West Midlands SMEs. If you’re ready to take your business to the next level, we’re here to help.

To begin, let’s start a conversation via our enquiry form and explore how we can work together. Following your enquiry, we will review your requirements and pass this information onto the relevant investment team who will be in touch to learn more about your business and goals.

Why choose FDC?

We are dedicated to empowering SMEs across the West Midlands with the financial support they need to scale, innovate, and lead. Our mission is clear: to be at the forefront of debt financing to fuel the next stage of your business’ success story.

With a holistic approach to every deal, our team of experienced investment professional help you navigate the funding process and gain a deep understanding of your business to offer more than just money. We believe in building relationships, understanding your business’ unique journey, and providing tailored support that respects your vision and ambitions. Committed to nurturing growing businesses and fostering regional economic growth.

Looking for investment?

Meet the investment team:

Need equity investment?

Mercia Ventures manages Midlands Engine Investment Fund II – Equity Finance for both the West Midlands and East Midlands. Find out more by visiting their website.

Available to transformative businesses within the West Midlands, equity finance is available of up to £5million.

Supporting innovative enterprises within the East Midlands, equity finance is available of up to £5million.