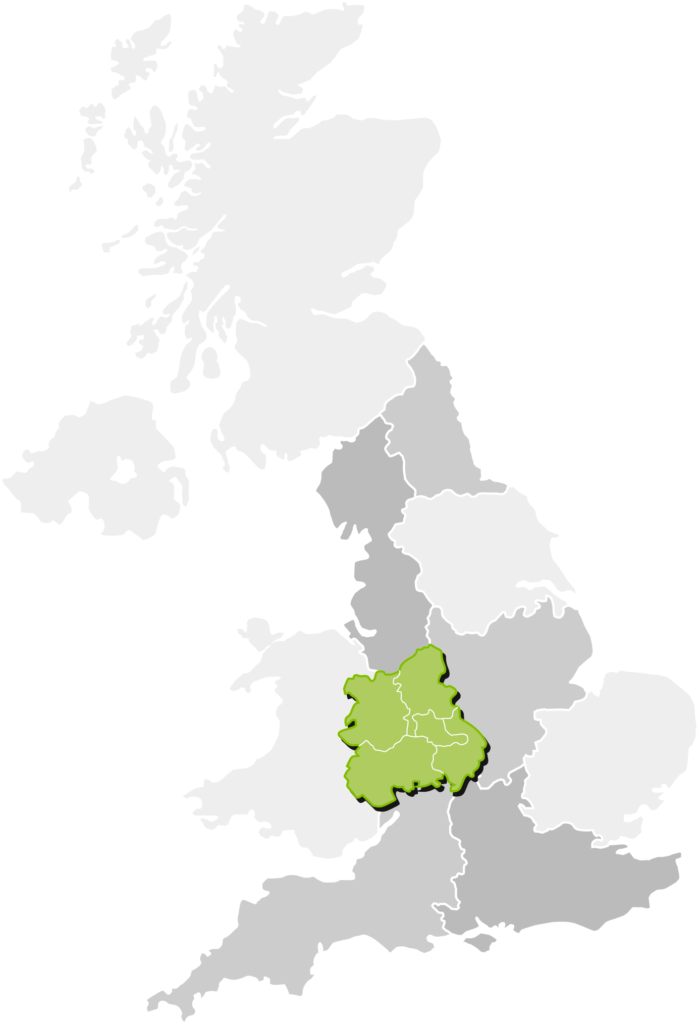

West Midlands Debt Funding

Driving business growth with flexible investment solutions

Investment from £100,000 for scaling SMEs

Whether you are a CEO of a SME looking to grow or an advisor to a innovative business, you will want to work with partners you can rely on. FDC has a wealth of banking, private equity, and industry experience, and therefore, is a partner you can trust. With plenty of loan funding options to choose from, FDC has the knowledge to help businesses develop.

Minimum loan investment from £100,000

FDC manages a range of funds available to SMEs, including the MEIF II Debt Finance for the West Midlands.

For businesses operating and based in the West Midlands

With growing regional presences, debt investment is available to SMEs across the nation.

For profitable SMEs trading over three years

Available to established and trading SMEs - Small to Medium sized Enterprises.

Any sector and business model considered

Flexible loan funding to support SMEs working in any sector, needing investment for any growth plans.

Apply here

Investment Hub

Download our investment info pack and subscribe

New fund announcement

Midlands Engine Investment Fund II – Debt Finance for the West Midlands

We’re delighted to be able to announce the launch of MEIF II – Debt Finance for West Midlands’ SME businesses. Available investment from £100,000 to £2million, to support your business’ growth ambitions. Find out more and apply online:

If your business meets the eligibility criteria of our funds, starting your investment journey is straightforward. Simply complete our online application form and share your business growth proposals with us. Then a member of the FDC team will will be in touch to discuss your business needs in more detail.

During our initial conversation, we’ll evaluate whether FDC funds are suitable for your needs and outline any additional information we may require to proceed.

If you feel that your business is not quite ready for FDC investment, you can still subscribe to our Investment Hub. A library of free resources, articles and tools to assist you with your business growth journey.

Sign up to Hub updates and get event invitations and relevant information straight to your inbox.

Why choose FDC?

Frontier Development Capital is at the forefront of debt funding, supporting a diverse array of sectors and transactions. We specialise in collaborating with business owners who seek an experienced and supportive funding partner.

At FDC, we prioritise professional relationships and align funding based around your business’ strategies. Successful investments hinge on strong mutual understandings, which is why we take a holistic approach to every deal and make investment decisions on a case-by-case basis.

Our investment team can advise on funding structures tailored for SME Funding and Property Finance. For more insights into how we operate and to discuss your specific needs, please get in touch.

#OneMercia - Part of Mercia Asset Management PLC

Your trusted partner for financing solutions

FDC is part of Mercia Debt, understanding the crucial roles that advisers and management teams play in securing financing solutions for businesses. For more information about funds managed by the Group, visit their website.

Need equity investment?

Providing venture capital, Mercia Ventures is a generalist investor investing £1m-£10m across the whole of the UK. For more information, visit their website.