Financing business growth

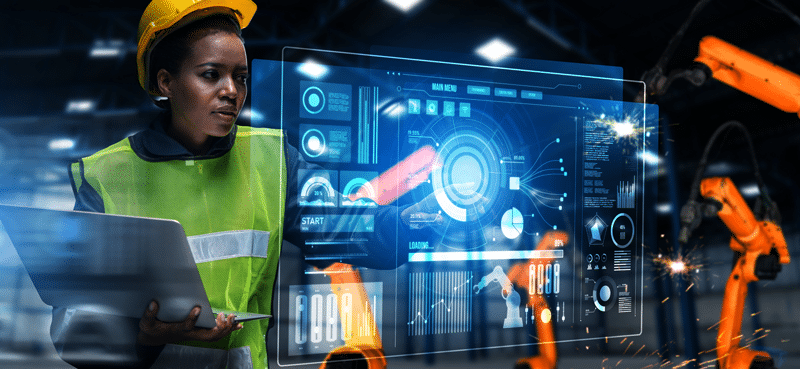

Empowering businesses through flexible investment solutions

Debt funding: The catalyst for growth and expansion

Debt funding is essential for driving growth and expanding your business, yet it often remains a complex area for many SMEs and property developers. As a primary driver for development, understanding and accessing the right kind of debt finance is crucial.

If you’re a business owner aiming to propel your company forward, it’s vital to connect with a funder that aligns with your vision and growth plans. At FDC, we recognise the pivotal role that decision-makers and management teams play in navigating financial solutions and offer range of tailored financing solutions to target your specific needs.

Whether you’re an ambitious founder seeking effective growth solutions, a management team looking for strategic investment, or a property developer planning a new regeneration project, we can provide access to debt investment to transform your business aspirations into reality.

Are you an SME looking for debt investment for growth?

Whether you are a CEO wanting to expand your business’ horizons, a management team looking to fund an MBI or a decision-maker in need of strategic funding, you will want to work with partners you can rely on. FDC has a wealth of banking, private equity, and industry experience and is a partner you can trust. With plenty of loan funding options to choose from, FDC has the knowledge to help businesses develop.

Our focus is on established SMEs – meaning they have at least 3 years of profitable trading and are ready to scale up – who are poised for further growth, from any sector.

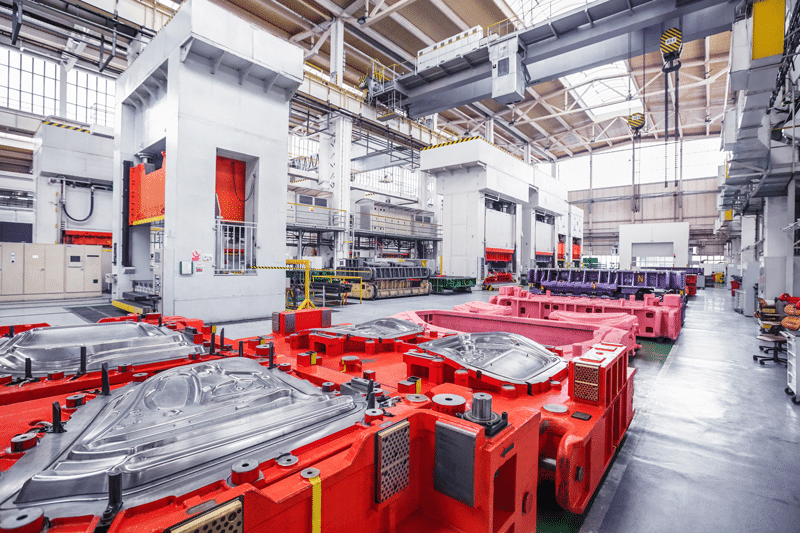

Are you a property developer looking to kick-start a new scheme?

Whether you are a commercial or residential developer, you will want to work with partners you can rely on. FDC has a wealth of property lending and industry experience and understand the market that you operate in. With a proven track record of deals that kick-start schemes as well as regenerate sites, we are the partner you can look to for support.

Our focus is on West Midlands-based developments, led by established and well-known developers.

Capital programmes designed to address specific market failures.

As well as our general debt funds and property finance funds, FDC provides access to to capital programmes that are dedicated to address these market failures and support businesses within any industry that need funding to drive innovation, job security, and growth.

Each fund has its own eligibility criteria, therefore we advise to get in touch with your business growth plans and we can help find the best fund to suit your needs.

Funds available:

If your business meets the eligibility criteria of our funds, starting your investment journey is straightforward. Simply complete our online application form and share your business growth proposals with us. Then a member of the FDC team will will be in touch to discuss your business needs in more detail.

During our initial conversation, we’ll evaluate whether FDC funds are suitable for your needs and outline any additional information we may require to proceed.

If you feel that your business is not quite ready for FDC investment, you can still subscribe to our Investment Hub. A library of free resources, articles and tools to assist you with your business growth journey.

Sign up to Hub updates and get event invitations and relevant information straight to your inbox.

Why choose FDC?

Frontier Development Capital is at the forefront of debt funding, supporting a diverse array of sectors and transactions. We specialise in collaborating with business owners who seek an experienced and supportive funding partner.

At FDC, we prioritise professional relationships and align funding based around your business’ strategies. Successful investments hinge on strong mutual understandings, which is why we take a holistic approach to every deal and make investment decisions on a case-by-case basis.

Our investment team can advise on funding structures tailored for SME Funding and Property Finance. For more insights into how we operate and to discuss your specific needs, please get in touch.

#OneMercia - Part of Mercia Asset Management PLC

Your trusted partner for financing solutions

FDC is part of Mercia Debt, understanding the crucial roles that advisers and management teams play in securing financing solutions for businesses. For more information about funds managed by the Group, visit their website.

Need equity investment?

Providing venture capital, Mercia Ventures is a generalist investor investing £1m-£10m across the whole of the UK. For more information, visit their website.